Experience the UPREIT Advantage

Sell your property to Rexford for liquidity, cash flow & tax deferral.

Experience the UPREIT Advantage

Sell your property to Rexford for liquidity, cash flow & tax deferral.

Why UPREIT?

Defer Taxes |

| Similar to a 1031 exchange |

Gain Tax Advantages |

| Tailored to each seller and transaction |

Earn Passive Income |

| Through common or preferred dividends |

Divide Ownership |

| Between partners with tax advantages |

Receive Rexford Shares |

| A $12.0B+ infill SoCal industrial REIT |

Why Rexford?

Increase Cash Flow |

| From Rexford's reliable track record of dividend growth |

Achieve Diversification |

| With Rexford's extensive portfolio in SoCal infill markets |

Unlock Growth |

| With potential to surpass your initial investment — find out how |

Enhance Liquidity |

| Convert OP units to Rexford stock (NYSE: REXR) |

Why Rexford?

Increase Cash Flow |

| From Rexford's reliable track record of dividend growth |

Achieve Diversification |

| With Rexford's extensive portfolio in SoCal infill markets |

Unlock Growth |

| With potential to surpass your initial investment — find out how |

Enhance Liquidity |

| Convert OP units to Rexford stock (NYSE: REXR) |

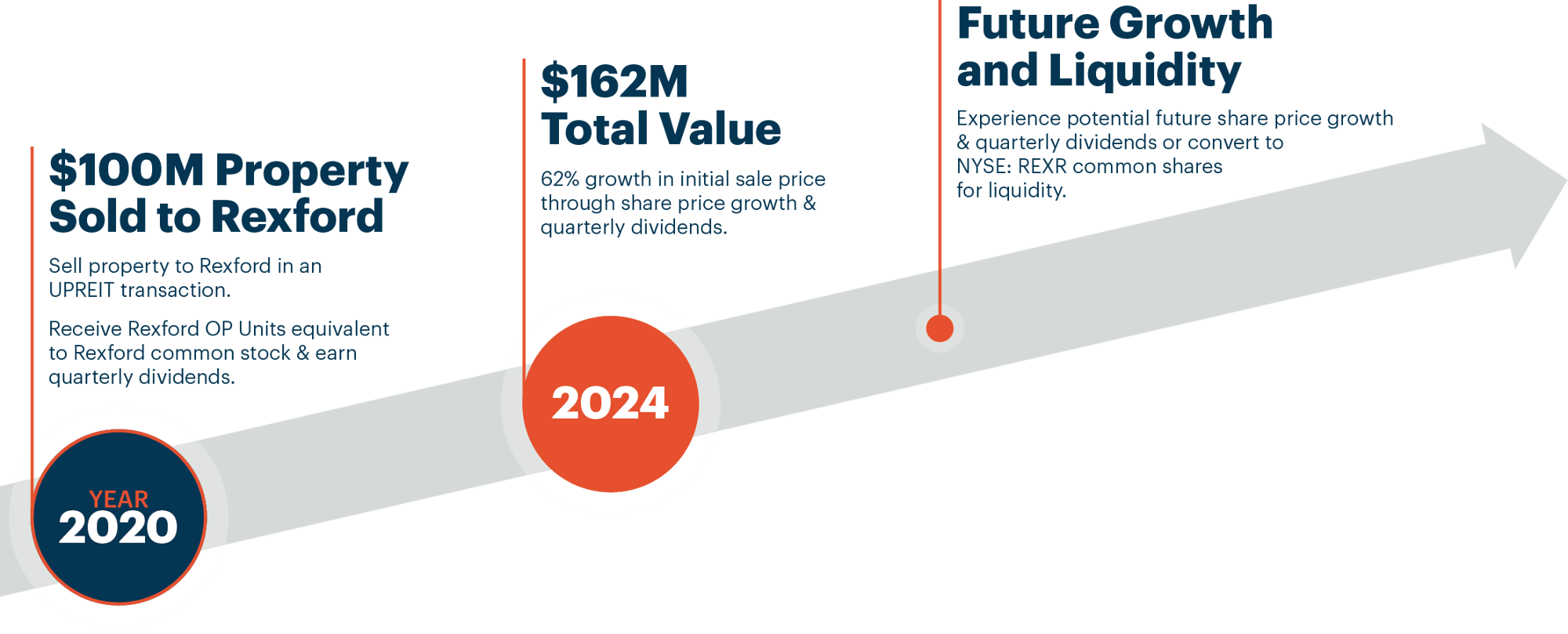

Case Study |

| How a property sale with Rexford through an UPREIT transaction produces cash flow through dividends, potential future value beyond the initial sale price and liquidity at your option. |

Your UPREIT Questions, Our Expert Answers

From tax advantages to partnership dynamics, we've addressed key questions to get you and your sellers started. Get ready to elevate your understanding and harness the power of UPREITs, how they work and how they can reshape your real estate investment strategy.

The information provided on this website is for informational and marketing purposes only and does not constitute tax or legal advice. Individual situations vary, and you should consult with your own tax, legal and financial advisors before entering into any UPREIT transaction. Rexford Industrial makes no representations or warranties regarding the applicability of any information provided here to your specific circumstances.

What is an UPREIT?

UPREIT, or Umbrella Partnership Real Estate Investment Trust, is a real estate investment transaction structure that allows sellers to contribute their properties into a partnership managed by a real estate investment trust (REIT) in exchange for Operating Partnership (OP) units on a predominantly tax-deferred basis.

What is an Operating Partnership Unit? How does it work?

In the context of Rexford, an Operating Partnership (OP) Unit is economically equivalent (and convertible on a one-to-one basis) to one common share of the Rexford REIT stock (NYSE: REXR). Unit holders enjoy similar benefits as common shareholders (such as dividend income and liquidity flexibility), with the addition of depreciation. The dividend rate and understanding of the OP unit's value are determined by our common stock share price, multiplied by the holder's OP units.

How does an UPREIT differ from a traditional real estate transaction?

In a traditional real estate transaction, property owners typically sell their properties in exchange for cash, which results in an immediately taxable event. In contrast, with an UPREIT transaction, a property owner may contribute their real property into a REIT in exchange for operating partnership units managed by the REIT, thereby deferring capital gains taxes and gaining interests and access to a diversified investment portfolio.

What if I want more cash flow?

In some cases, preferred OP units at premium dividend rates may be available depending on the property owner’s income needs, which preferred units may then be converted to standard OP units. Generally, to receive a dividend rate higher than the common stock dividend, there is a conversion premium whereby the seller receives an agreed upon high dividend rate at a lower OP unit count.

What are the main advantages of using an UPREIT structure?

The main advantages of using an UPREIT structure include tax deferral on capital gains, diversification of real estate holdings, increased liquidity and flexibility through ownership of partnership units and potential for income and growth from the REIT's diversified portfolio.

Are there any tax benefits associated with UPREITs?

Yes, UPREITs offer tax benefits, primarily by deferring capital gains taxes. When operating partnership owners contribute their properties to an UPREIT in exchange for OP units, they can defer capital gains taxes until they sell their OP units or the REIT sells the underlying properties (for which the REIT may agree to provide limited protection against and indemnification.)

Another tax benefit is that OP unit holders may benefit from depreciation pass-through.

Note: there may be some tax assessments associated with dividends or distributions from OP units, as the transaction may vary.

How does the process of contributing a property through an UPREIT work?

The process of contributing a property through an UPREIT involves transferring ownership of the property to an operating partnership managed by the REIT in exchange for OP units. This transfer is structured as a predominantly tax-deferred transaction, allowing property owners to defer capital gains taxes on their property's appreciation.

How do UPREITs generate income for property owners?

UPREITs generate income flexibility for OP unit owners, which can be through the form of sale of OP Units (at the OP unit owner’s discretion), convertible preferred OP unit distributions (i.e., dividends — if available at the time of transaction) or standard OP unit distributions (i.e., dividends). The per OP unit dividends are typically the same as the REIT’s per share common stock (NYSE: REXR) dividends. Because the OP units can be exchanged on a one-to-one basis for REIT common stock and then sold on the New York Stock Exchange, the value of the OP units has the potential to increase (or decrease) as the common stock price changes. However, it's important to note that the potential income benefit and appreciation are generally limited by our then-current stock dividends and price.

Do I have to take all UPREIT units? Can I take some cash/some UPREIT?

No, you don’t have to take all OP units. Yes, you can take some portion in cash! Rexford has completed transactions where OP unit owners have opted to receive a combination of both cash and OP units. Depending on the structure of the seller’s own entity, it is common for each individual partner to have some level of input and autonomy in making decisions regarding the allocation of their portion to address each partner’s financial needs.

Does my C-Corp/Ownership structure qualify for UPREIT?

It's important to consult with your tax advisor, but many organizational structures are generally eligible. However, please note that C-corps are not eligible for UPREIT participation.

What important legal disclaimer must I read if I am interested in an UPREIT?

In an UPREIT transaction, a property contributor may obtain ownership in Rexford Industrial LP, a wholly-owned subsidiary of Rexford Industrial Realty, Inc. (NYSE: “REXR”), whose ownership units will be convertible into REXR shares on a one-for-one basis, subject to certain terms, conditions and limitations contained in the partnership agreement. This information is provided only as an example of how an UPREIT transaction may be structured. The information is provided only to the individual to whom it is provided by Rexford and is not for general or group dissemination. This is not an offer to sell or a solicitation of any offer to buy any securities nor shall there be any sale of these securities in any state in which such solicitation or sale would be unlawful prior to registration or qualification of these securities under the laws of any such state. Offers are made only by prospectus or other offering materials. This example of an UPREIT transaction may contain forward-looking statements within the meaning of the federal securities laws, which are based on current expectations, forecasts and assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts, and forward-looking statements are not guarantees of future performance. For a further discussion of these and other factors that could cause Rexford’s future results to differ materially from any forward-looking statements, see the reports and other filings by Rexford with the U.S. Securities and Exchange Commission, including Rexford’s most recently filed Annual Report on Form 10-K. Rexford disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes. Example of contribution of your property TAX DEFERRED in exchange for ownership in Rexford Industrial Realty (NYSE: REXR) operating partnership. No tax, legal or investment advice is contained in or intended by this communication (or any related discussions), and consultation with your tax, legal, estate planning or financial advisors is recommended. Past performance does not guarantee future performance and blackout periods may apply. Each contributor must be an accredited investor for SEC purposes. Enterprise Value (net debt plus equity).

Your UPREIT Questions, Our Expert Answers

From tax advantages to partnership dynamics, we've addressed key questions to get you and your sellers started. Get ready to elevate your understanding and harness the power of UPREITs, how they work and how they can reshape your real estate investment strategy.

The information provided on this website is for informational and marketing purposes only and does not constitute tax or legal advice. Individual situations vary, and you should consult with your own tax, legal and financial advisors before entering into any UPREIT transaction. Rexford Industrial makes no representations or warranties regarding the applicability of any information provided here to your specific circumstances.

What is an UPREIT?

UPREIT, or Umbrella Partnership Real Estate Investment Trust, is a real estate investment transaction structure that allows sellers to contribute their properties into a partnership managed by a real estate investment trust (REIT) in exchange for Operating Partnership (OP) units on a predominantly tax-deferred basis.

What is an Operating Partnership Unit? How does it work?

In the context of Rexford, an Operating Partnership (OP) Unit is economically equivalent (and convertible on a one-to-one basis) to one common share of the Rexford REIT stock (NYSE: REXR). Unit holders enjoy similar benefits as common shareholders (such as dividend income and liquidity flexibility), with the addition of depreciation. The dividend rate and understanding of the OP unit's value are determined by our common stock share price, multiplied by the holder's OP units.

How does an UPREIT differ from a traditional real estate transaction?

In a traditional real estate transaction, property owners typically sell their properties in exchange for cash, which results in an immediately taxable event. In contrast, with an UPREIT transaction, a property owner may contribute their real property into a REIT in exchange for operating partnership units managed by the REIT, thereby deferring capital gains taxes and gaining interests and access to a diversified investment portfolio.

What if I want more cash flow?

In some cases, preferred OP units at premium dividend rates may be available depending on the property owner’s income needs, which preferred units may then be converted to standard OP units. Generally, to receive a dividend rate higher than the common stock dividend, there is a conversion premium whereby the seller receives an agreed upon high dividend rate at a lower OP unit count.

What are the main advantages of using an UPREIT structure?

The main advantages of using an UPREIT structure include tax deferral on capital gains, diversification of real estate holdings, increased liquidity and flexibility through ownership of partnership units and potential for income and growth from the REIT's diversified portfolio.

Are there any tax benefits associated with UPREITs?

Yes, UPREITs offer tax benefits, primarily by deferring capital gains taxes. When operating partnership owners contribute their properties to an UPREIT in exchange for OP units, they can defer capital gains taxes until they sell their OP units or the REIT sells the underlying properties (for which the REIT may agree to provide limited protection against and indemnification.)

Another tax benefit is that OP unit holders may benefit from depreciation pass-through.

Note: there may be some tax assessments associated with dividends or distributions from OP units, as the transaction may vary.

How does the process of contributing a property through an UPREIT work?

The process of contributing a property through an UPREIT involves transferring ownership of the property to an operating partnership managed by the REIT in exchange for OP units. This transfer is structured as a predominantly tax-deferred transaction, allowing property owners to defer capital gains taxes on their property's appreciation.

How do UPREITs generate income for property owners?

UPREITs generate income flexibility for OP unit owners, which can be through the form of sale of OP Units (at the OP unit owner’s discretion), convertible preferred OP unit distributions (i.e., dividends — if available at the time of transaction) or standard OP unit distributions (i.e., dividends). The per OP unit dividends are typically the same as the REIT’s per share common stock (NYSE: REXR) dividends. Because the OP units can be exchanged on a one-to-one basis for REIT common stock and then sold on the New York Stock Exchange, the value of the OP units has the potential to increase (or decrease) as the common stock price changes. However, it's important to note that the potential income benefit and appreciation are generally limited by our then-current stock dividends and price.

Do I have to take all UPREIT units? Can I take some cash/some UPREIT?

No, you don’t have to take all OP units. Yes, you can take some portion in cash! Rexford has completed transactions where OP unit owners have opted to receive a combination of both cash and OP units. Depending on the structure of the seller’s own entity, it is common for each individual partner to have some level of input and autonomy in making decisions regarding the allocation of their portion to address each partner’s financial needs.

Does my C-Corp/Ownership structure qualify for UPREIT?

It's important to consult with your tax advisor, but many organizational structures are generally eligible. However, please note that C-corps are not eligible for UPREIT participation.

UPREIT Resource Hub |

|

|

Explore resources on Rexford's UPREIT offerings. |

|

| — UPREIT INFO BROCHURE (PDF) | |

| — PAST REXFORD UPREIT TRANSACTIONS (PDF) | |

| — REXFORD INVESTOR PRESENTATION (PDF) | |

| — LIMITED PARTNERSHIP AGREEMENT (PDF) | |

| — REXFORD DIVIDENDS & SPLITS | |

| — REXFORD SEC FILINGS | |

UPREIT

Resource Hub

Explore resources on Rexford's UPREIT offerings.

— PAST REXFORD UPREIT TRANSACTIONS (PDF)

— REXFORD INVESTOR PRESENTATION (PDF)